How to Use an LLC for Rental Property Tax Benefits & More

Using a limited liability company for a rental property business is a great way to protect your liability, get tax benefits, and gain other advantages for your business. Not only are your personal assets protected in the event of a lawsuit related to injury on your property, but you will also be able to keep any rental-related debts separate from your own, thanks to the liability protection that an LLC offers. Before you make the decision to form an LLC for your rental property, you should be sure to consider all of the advantages and disadvantages that come along with it.

Table of Contents

- How to Use an LLC for Rental Property

- LLC Tax Benefits for Rental Property

- Protecting Your Assets

- Commingling Funds

- Managing Your Money

- Marketing Strategies and Professionalism

- Liability Protection: Insurance or LLC?

- Adding Properties to an LLC after the Fact

- Disadvantages of Using an LLC for a Real Estate Rental Business

- How to Form an LLC

How to Use an LLC for Rental Property

If you choose to use an LLC for your rental property, this means that your company will officially operate as the landlord, rather than you as the individual. This business structure will give you added personal liability protection, as well as additional benefits, such as a more professional business appearance. If you use an LLC for your rental property, you will also have some flexibility in how you choose to structure your company. You can be the sole owner of your company or you can include a spouse or other business partners in your ownership. The way your LLC’s taxes are handled can vary depending on how many owners your company has and how you choose to set this up with the IRS. As is discussed later, you have some options in this area and can decide which tax situation is most beneficial for you.

You will then acquire your rental property in the LLC’s name. Ideally, it can be simpler to form your new company before acquiring rental properties. This way, your LLC can hold the property title from the start, which saves you a bit of time.; oOn the other hand, transferring existing property ownership from yourself to the LLC will require a few additional steps.

Once you register your LLC, there are a few basic steps you will need to take in order to set up your rental company, such as the following:

- Obtain a Tax Identification Number (otherwise known as an Employer Identification Number or EIN).

- Open a bank account in the name of the LLC.

- If your rental homes are currently in your name, you will then need to file the appropriate deed—usually a quit claim deed—to transfer the title of the property to the LLC. If possible, refinance the property into the LLC's name or ask your bank whether you can transfer the mortgage to the LLC without refinancing. Always contact your lender or bank before taking this step. If your mortgage has a due-on-sale clause, it could cause you to have to pay the mortgage in full if you transfer without contacting the mortgage lender first.

If you have more than one rental property, you will need to decide whether to set up separate LLCs for each property. As discussed below, doing this can make financial matters more distinct between properties and easier to avoid commingling funds, but you will also need to consider any additional costs that may be associated with setting up and maintaining multiple companies.

LLC Tax Benefits for Rental Property

This means that the LLC does not pay taxes; the business owner pays the taxes, thus eliminating the double taxation that occurs if you were to form a corporation instead. If you are the sole member of your LLC, you will be taxed similarly to a sole proprietorship while enjoying the additional benefit of liability protection.

If you own a multi-member LLC, then the taxes may be handled differently and you also have a few options for how to file your company with the IRS. Taxes are still passed through the LLC to the members; however, the members must complete a Schedule C, Schedule K, or Form 1065 with their income tax return. Each member of the LLC will claim their share of the income, not the entire income that the LLC earned that year. You might also elect to have your LLC taxed as an S corporation or a C corporation for a different tax structure. Prior to setting up your LLC, it is advisable to discuss your situation with a tax professional to find out the best way to set up the company and to minimize your tax burden.

One of the major benefits of having your property owned by an LLC is that you will be able to take certain deductions on your taxes that you otherwise would not be eligible for. Additionally, if you run your company out of a home office, you may even be eligible for other additional deductions, such as utilities, repairs and maintenance, or dwelling insurance costs.

Protecting Your Assets

If you are sued because someone is injured on your rental property, including a guest of the tenant, then your personal assets are not necessarily protected as an individual landlord. Regardless of how small or insignificant the lawsuit may seem, it can be a costly process to defend your assets. If you put your rental properties in an LLC, you will still have to pay for the cost of for an attorney should you be involved in a lawsuit; however, because the LLC is acting as the landlord, your personal assets are protected. The party that is suing may only go after the assets held in the LLC. Thus, if you have several properties, you may want to have a separate LLC for each property for added asset protection. Keeping each property in separate companies will further limit the assets that are vulnerable in a given lawsuit involving one of your properties.

You will also have liability protection that applies to situations involving creditors that are seeking to resolve debts. If you keep your rental property and your personal affairs completely separate from each other, your company assets can be protected from creditors in issues involving your personal debt and vice versa.

If you want to take asset protection a step further, having your property in an LLC can also provide some added benefits in estate planning.

Asset Protection Tip

Make sure your estate plan gives clear, concise instructions to avoid confusion.

There are certain types of trusts that will automatically allow assets to easily pass on to your children in this case. To do this, you can set up a trust and then allow the trust to own your interest in the LLC. This adds another layer of protection for your assets, particularly for your heirs or in the event you become incapacitated or die. Since the property is a separate entity, the LLC ownership can be passed on after death and avoid probate if you have structured it this way. This type of estate planning for your company has the potential to simplify and shorten the process of transferring the rental properties that your LLC owns onto your heirs after death. However, because certain trusts do not protect your assets from creditors, you should speak with a probate attorney about how to structure this and utilize the proper trust for your specific situation.

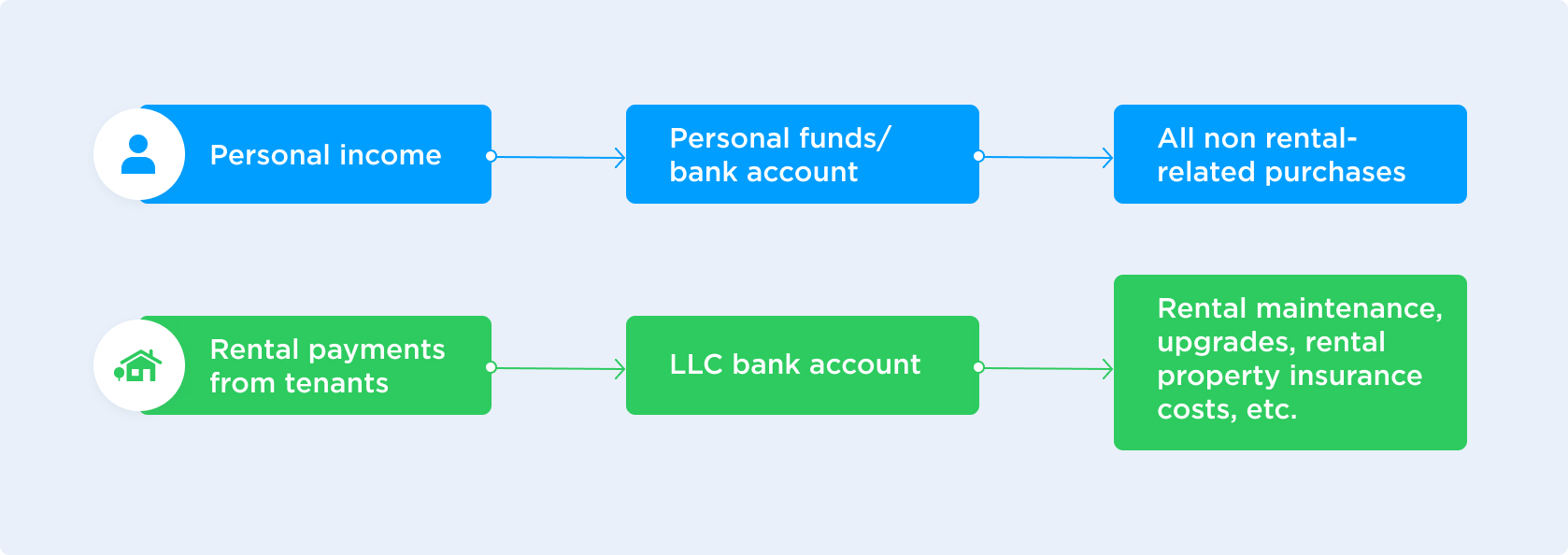

Commingling Funds

Once you have set up an LLC for your rental property, you must be careful not to commingle any of the money earned through the LLC with your own personal money. Setting up a bank account for the LLC allows you to easily track business expenses and income as long as you do not commingle any funds. You should keep separate accounts for your LLC and your personal funds in order to easily maintain this distinction of funds. In other words, you should not buy supplies or make repairs for the rental home with your personal money, nor should you buy personal items, such as clothing or food for yourself, with money from the LLC. If you do commingle funds and at some point you are sued by a tenant or a tenant's guest, you could forfeit the limited liability protection you had by putting the rental property in the LLC in the first place. Additionally, if you are not careful to keep your LLC funds separate from personal funds, you could breach the liability protection, and should your company be sued over a debt, creditors may be able to go after your personal assets.

Managing Your Money

When you put your real estate rentals into an LLC, you will be able to manage your rental income more easily.

Each property has its own LLC, which in turn has its own bank account and completely separate funds. Rental income goes into the bank account, and mortgage payments, repair costs, and other property costs come out of the same bank account associated with that property and its company. You will also have a separate bank statement tracking the costs and income for each property. This way, you will not have to remember to mark the receipts to determine which property they belong to and keep them organized in another way.

When it comes to doing your taxes, this method ensures that everything is already separate. That way, the deductions that should be taken against a certain property are sure to be applied in the correct place. This could make a big difference in how your tax burden is handled, depending on the amount of interest you are paying on the mortgage for one particular property. This also depends on how you set the LLC up. You may have to file additional forms, such as a Schedule C, if you set the LLC up in a certain way.

If you prefer using a credit card for maintenance and other rental-related costs, then each LLC may also be able to acquire its own credit card. This way, when you need to purchase items for upgrades or repairs, you can be sure to use the credit card or bank account directly associated with that property.

When you apply for loans for the properties, a property that is not doing well financially will have less effect on another property that is more successful. If you are keeping the properties in separate LLCs, then a financially successful property likely has the income to support the loan. However, if both are contained within the same LLC and you have one property that is struggling, those losses will bring down the income for any of your other properties that may be doing much better. If each is kept separate in different LLCs, you will have an easier time getting the loan for the property that is doing well.

Marketing Strategies and Professionalism

If you have, or plan to have, more than one rental property, then setting up an LLC makes it easier to market those properties under a brand name. Branding can be a great way to attract potential tenants and you are able to choose a company name that might be easier to remember than your own name. This will also make your business look more professional to investors;, for instance, if you need to borrow money or are looking to acquire additional rental properties. You also have the added benefit of it being much easier to keep track of the money your business earns and spends since it is kept separate from your personal finances.

Liability Protection: Insurance or LLC?

Some people may prefer to use liability insurance for their business, rather than an LLC, for protection. While this is a great starting point in protecting your liability as a business owner, it does not provide the same level of protection as an LLC. Liability insurance has some disadvantages and limitations, including, but not limited to, the following:

For example, you might have a situation where your insurance does not cover a dog bite that occurred on your property because the small print states that the policy will not cover damage or injury from certain breeds. In this case, the injured party may be able to go after your personal assets in their lawsuit if you do not have an LLC set up to protect you. The ideal situation for liability protection is to put a rental property in an LLC as well as insuring the property.

Adding Properties to an LLC after the Fact

In some cases, you may wish to transfer a rental property that you already own into a newly created limited liability company.

Always check with your mortgage company about transferring a property from your name to the name of your LLC. It is easier to create an LLC first and then purchase rental properties in the LLC's name than to transfer existing rental properties and mortgages into the LLC.

Disadvantages of Using an LLC for a Real Estate Rental Business

Using a limited liability company to protect your rental properties has many advantages, but a few disadvantages too. One of the disadvantages of using an LLC for a real estate rental business is the cost. There are various fees involved with setting up and maintaining an LLC, which will vary by state. You can generally expect these initial startup costs to range from $100 to $300, with ongoing operating costs for an LLC usually being around $200 annually. You should weigh the benefits and costs of starting an LLC and be sure that the tax benefits and additional protections are worth the start-up costs in your state.

Depending on the structure of your LLC, you may also have additional tax consequences applied to your business, so be sure you understand what your tax obligations will be and whether the additional deductions and LLC tax structure will be beneficial to your situation.

Another disadvantage is that forming a new company and all that comes with it can seem like a considerable amount of paperwork and additional organization for your rental property. However, taking these steps now can save you a lot of trouble in the future, should you end up facing a lawsuit or other issue. You can also use a business formation service such as LegalNature to simplify the process and ensure that you have all of the proper legal documentation for your rental property business.

How to Form an LLC

If you decide to form an LLC for your rental company, your first step is to file articles of organization and begin the process of forming your new company. You can then apply for an EIN if necessary, as well as opening a separate bank account and/or credit line for each rental property LLC that you start. Forming a new company for your rental property might seem like a daunting venture at first, but LegalNature is here to help you with all of your business needs. Our business formation services can guide you through each step of the process in starting your new company and we offer all of the necessary paperwork, additional services such as expedited filing, as well as information on filing fees for any state. Our easy-to-use forms and business formation services mean that you can be on your way to starting your new business in minutes. Create your articles of organization and start an LLC today.