Step-by-step guidance to help you determine the options you need

Throughout the form, we explain all the terms and you’ll be guided on making the best choices for your LLC.

Edit business team

Add LLC Members

Use this LLC operating agreement addendum form to add new members, owners, or partners to an LLC.

Edit business details

Make LLC Changes

Use this LLC amendment form to update your LLC's name, address, and more with the Secretary of State.

When To Use This Document

You are forming or plan to form an LLC

To fulfill your obligations under state law

You want to make sure your company is legally compliant and presentable for banks and investors

You want to ensure that all current and future members know their rights and obligations

What our customers are saying

How to complete your LLC operating agreement:

Complete Obligations

Gather Information

Gather all relevant information, including the LLC’s address, main business activity, member capital contributions, and agreed distribution of profits.

Man Laptop Questions

Answer Key Questions

Use the information you collected to complete the operating agreement. We make this easy by guiding you each step of the way and helping you to customize your document to match your specific needs. The questions and information we present to you dynamically change depending on your answers and the state selected.

Review and Sign

Review and Sign

It is always important to read your document thoroughly to ensure it matches your needs and is free of errors and omissions. After completing the questionnaire, you can make textual changes to your document by downloading it in Microsoft Word. If no changes are needed, you can simply download the PDF version and sign. These downloads are available by navigating to the Documents section of your account dashboard. When signing the document, be sure to follow any additional instructions related to signing and witnessing the document. Any such instructions will either be located next to the signature line or in the instructions attached at the end of the document. When using a notary, you must wait to sign the document until they are present.

Distribute and Store Questions

Distribute and Store Copies

At a minimum, all parties that sign the document should receive a copy once it is fully executed (everyone has signed). Other interested parties may need or want copies as well. Be sure to store your copy in a safe location. It is a good idea to keep both a physical and electronic copy.

Review and Update

Periodically Review and Update

It is easy to forget the ins and outs of your operating agreement. Periodically reviewing it will help you stay familiar with any responsibilities or requirements so that you can determine when it needs changes or additions. As your policies and membership change, you will need to update your operating agreement using an LLC operating agreement amendment. Typically, employers do this every two or three years.

Create other documents

Complete Related Documents

Completing additional documents will help protect the company and its owners from liability. For instance, an LLC membership admission agreement will help your LLC officially bring new members on board and ensure that the company fairly integrates the new members and their valuable contributions. Your LLC should also use resolutions at all important meetings to clearly and formally document the decisions being made. LLCs often need to show outside investors and potential partners the agreed resolutions.

Create your own business

LegalNature can help you form your company quickly and easily. You can choose between 4 types of companies - LLC, S Corp, C Corp, or a Nonprofit.

Help Guide

Similar to a partnership agreement or shareholder agreement, the LLC operating agreement defines the rights and duties of the LLC members and outlines how the LLC will be owned and operated. It is an essential document that all LLCs need to create and keep updated.

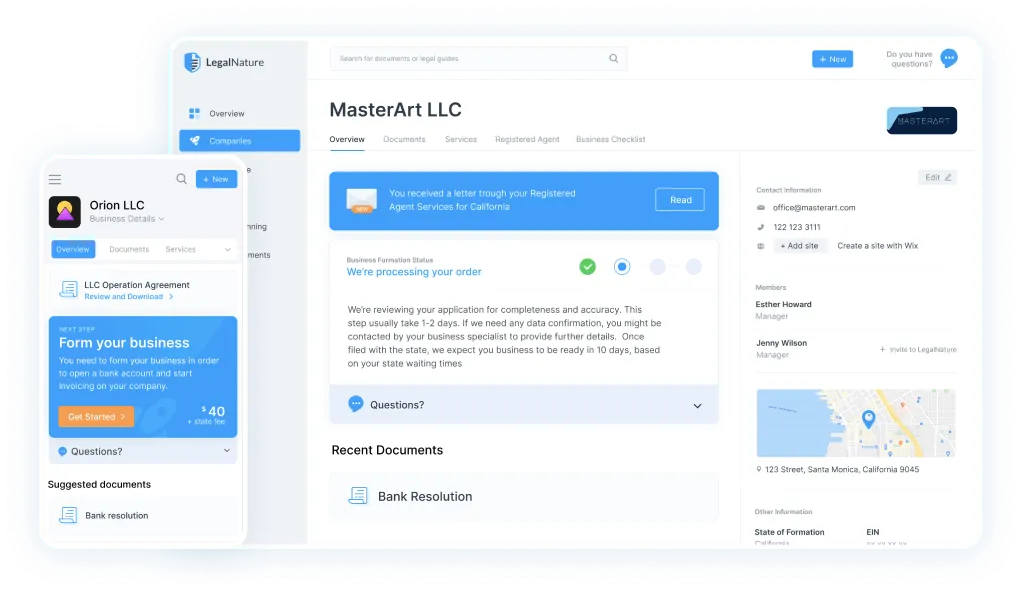

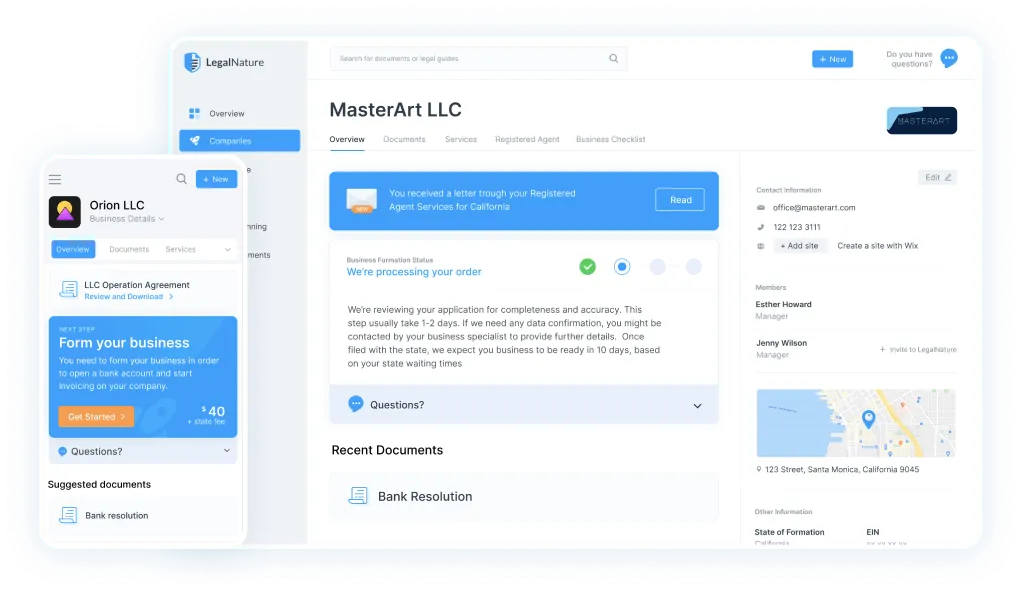

Introducing, your business command center

You’ll get a secure personalized dashboard that stores all of your legal forms. Edit, download, and print your documents at any time from any device.

Fast & Easy

Quickly create new documents or business services.

Safe & Secure

Your documents and information are always kept private.

Reliable & Trustworthy

Over 4,000 five star reviews from our customers.

Access Anytime

Everything you need, directly from your dashboard.