Why do I need to file articles of dissolution?

To avoid future state and federal taxes

To protect yourself from future liability

To put creditors on notice

It is legally required

Dissolve a company in 3 easy steps

End Your Legal Liability

Until a company has been formally dissolved, its owners will continue to be held legally responsible for its obligations. Terminating the company will protect the owners from incurring additional liabilities.

Avoid Fees

Companies must continue paying all mandatory state and federal fees until they have been officially dissolved.

Save Time

Let our knowledgeable staff help you complete your articles of dissolution, saving you from having to research the requirements yourself and communicate with the state.

Quick and Easy

Answer our short questionnaire and let us take it from there. We will keep you posted regarding the status of your application and let you know when your dissolution has been approved.

What our customers are saying

How to permanently close your company

Team

Vote to Dissolve Your Business

Schedule a meeting with the business owners, partners or Board of Directors and take a formal vote on closing the business. This vote needs to be officially recorded.

File document / complaint

File Your Last Tax Return

Pay any outstanding taxes and check the “final return” box when you file your corporate tax return. This lets the IRS know that you will not be filing future returns because your business is closing. If your business is an LLC taxed as a partnership, you also need to report shareholder allocations (and losses) for partners on Schedule K-1.

Eviction Notice

Cancel Business Permits and Licenses

If you applied for any business permits or licenses, contact each government office or agency where you applied and let them know your business is no longer operating.

Review and Update

Prepare Articles of Dissolution

Articles of dissolution are required by the state agency responsible for business filings in your state. We prepare your articles of dissolution based on your specific state requirements.

Review and Sign

File Articles of Dissolution

To close your business, we file the articles of dissolution with your state business filing agency. This document lets your state know that you are no longer operating as a company.

PoA Options

Additional Steps

If applicable, you may also need to pay creditors, close your business bank account(s), and distribute any outstanding funds to the business owners.

Help Guide

Start a new business

LegalNature can help you form a new company quickly and easily. You can choose between four types of companies: LLC, S Corp, C Corp, or Nonprofit.

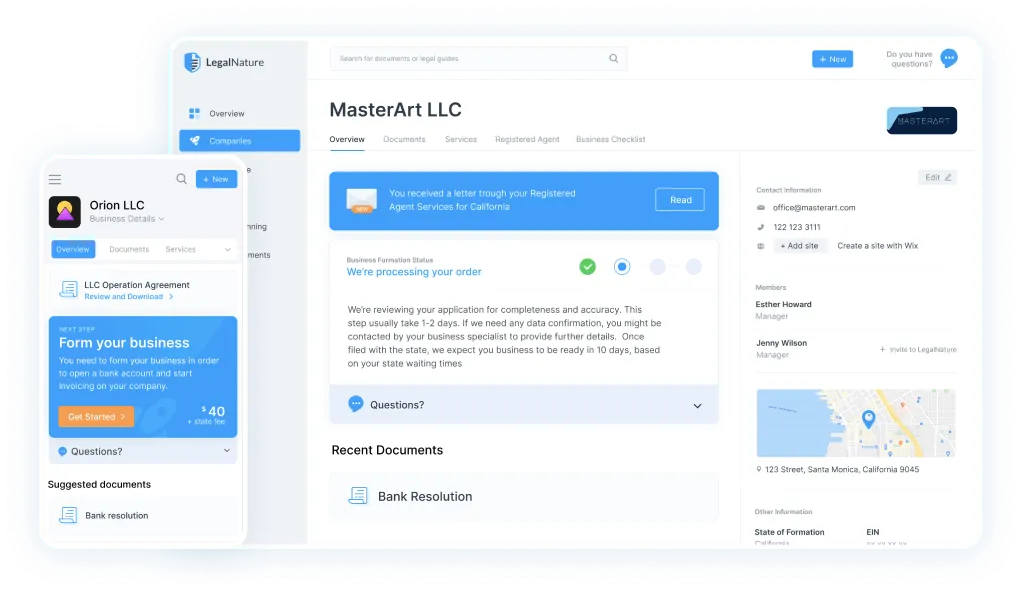

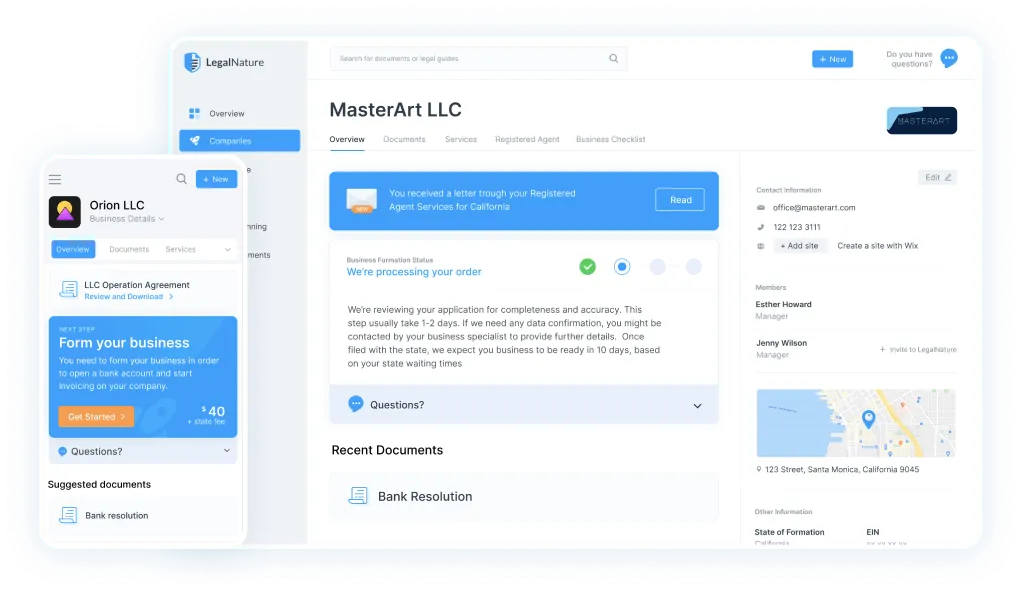

Introducing your business command center

You’ll get a secure personalized dashboard that stores all of your legal forms. Edit, download, and print your documents at any time from any device.

Fast & Easy

Quickly create new documents or business services.

Safe & Secure

Your documents and information are always kept private.

Reliable & Trustworthy

Over 4,000 five star reviews from our customers.

Access Anytime

Everything you need, directly from your dashboard.