When to use a banking resolution

To open and operate a company bank account

To prove authority to financial institutions

To appoint or change bank signatories for your company

To authorize other financial decisions on behalf of a company

What our customers are saying

Create your banking resolution in 3 steps

Complete Obligations

Gather Information

As you complete your banking resolution you will need to provide certain relevant information, including the name of the financial institution and the names of those authorized to transact on the account.

Man Laptop Questions

Complete the Questionnaire

Our questionnaire will help you customize your document for your company, providing step-by-step instructions. You may notice that the questions presented to you change depending on how you answer them.

Complete Obligations

Review and Adopt

Review your completed resolution in its entirety to ensure that it meets your needs and is free of errors. While you do not need to sign the banking resolution, it must be formally adopted during a board meeting by the secretary or other authorized corporate officer.

Start a new business

LegalNature can help you form a new company quickly and easily for as low as $39! You can choose between LLC, S Corp, C Corp, or Nonprofit.

Help Guide

Use a banking resolution to formally authorize opening a company bank account. Below are some helpful explanations of the key considerations when creating this document.

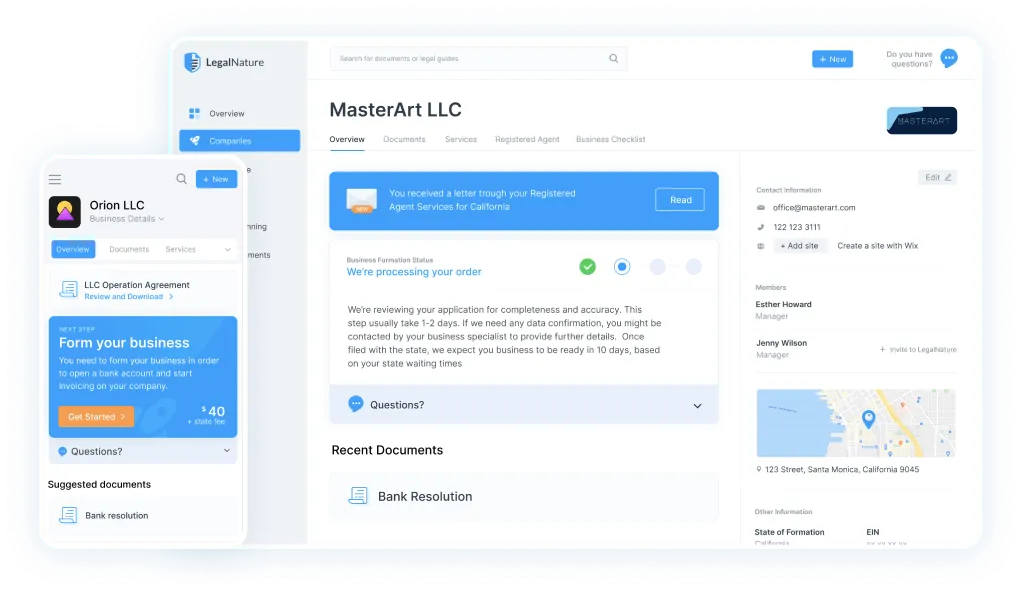

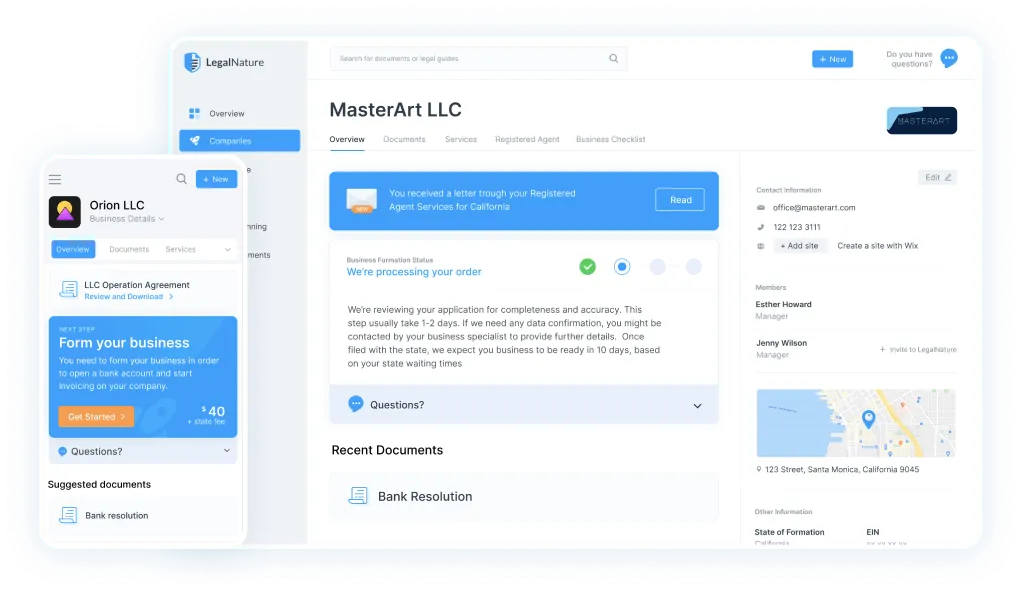

Introducing your business command center

You'll get a secure personalized dashboard that stores all of your documents. Edit, download, and print your documents at any time from any device.

Fast & Easy

Quickly create new documents or business services.

Safe & Secure

Your documents and information are always kept private.

Reliable & Trustworthy

Over 4,000 five star reviews from our customers.

Access Anytime

Everything you need, directly from your dashboard.