Our partnership agreement

Defines the relationships, duties, contributions, and responsibilities of partners

Specifies how capital, profits, and losses will be divided

Is compliant throughout all states and the District of Columbia

Provides step-by-step guidance to easily construct your partnership agreement

Complete your partnership agreement in 3 steps

Complete Obligations

Gather Information

As you complete your partnership agreement, you will need to provide certain relevant information. This includes the partnership address, partner capital contributions, ownership percentages, and management roles.

Man Laptop Questions

Complete Our Short Questionnaire

Use the information you collected to complete the partnership agreement. We make this easy by guiding you each step of the way and helping you to customize your document to match your specific needs.

Review and Sign

Review and Sign

It is important to read your agreement thoroughly to ensure the document is free of errors and omissions. After completing your agreement, all partners are required to sign the agreement to make it legally binding.

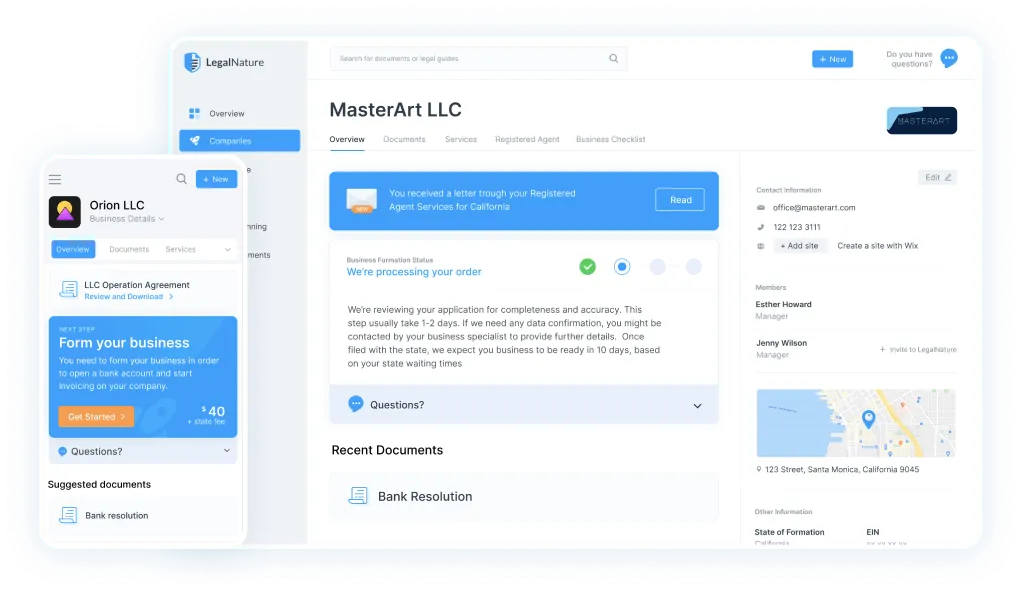

Start your business

LegalNature can help you form a new company quickly and easily for as low as $39! You can choose between LLC, S Corp, C Corp, or Nonprofit.

Help Guide

Our general partnership agreement solidifies the relationship between business partners and is an important tool for laying the groundwork for a successful, long-term business venture. The following instructions provide key insights and considerations when creating this essential document.

What our customers are saying

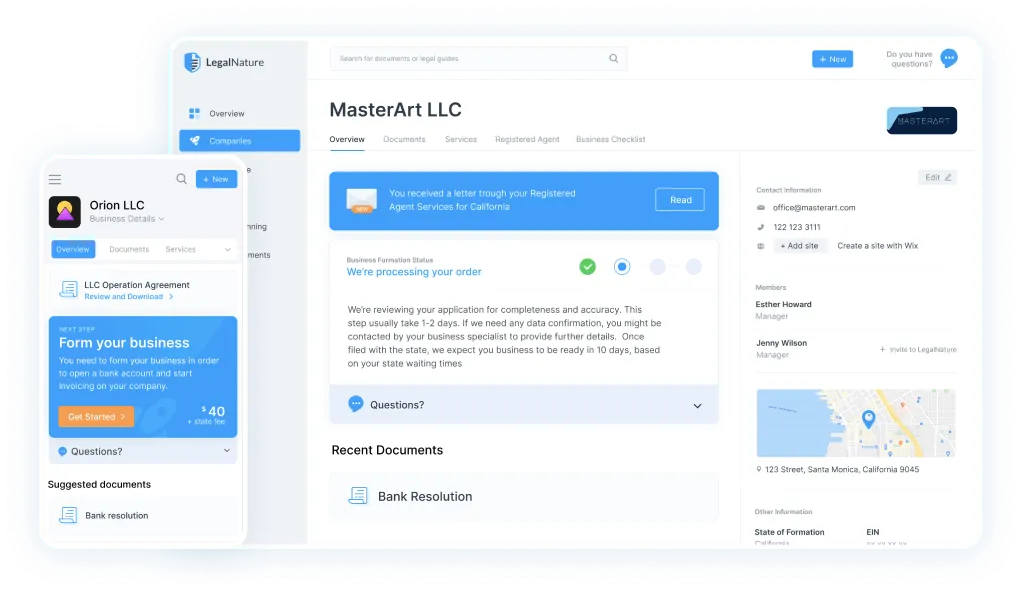

Everything you need for your legal matters, one click away

You'll get a secure personalized dashboard that stores all of your legal forms. Edit, download, and print your documents at any time from any device.

Fast & Easy

Quickly create new documents or business services.

Safe & Secure

Your documents and information are always kept private.

Reliable & Trustworthy

Over 4,000 five star reviews from our customers.

Access Anytime

Everything you need, directly from your dashboard.