Our indemnity agreement

Is designed to offer protection during contracts, activities, or services

Offers different levels of indemnity and protection to fit your needs

Is compliant throughout all states and the District of Columbia

Provides step-by-step guidance and dynamically adjusts to your needs

What our customers are saying

Create your indemnity agreement in 3 steps

Complete Obligations

Gather Information

As you complete your indemnity agreement, you will need to provide certain relevant information. This includes the name and address of each party and the date your agreement should go into effect.

Man Laptop Questions

Complete Our Short Questionnaire

Use the information you collected to complete the indemnity agreement. We make this easy by guiding you each step of the way and helping you to customize your document to match your specific needs.

Review and Sign

Review and Sign

It is always important to read your document thoroughly to ensure it matches your needs and is free of errors and omissions. When signing your agreement, be sure to follow any additional instructions related to signing and witnessing the document.

Help Guide

A indemnity agreement is an excellent way to help parties accomplish their goals by better dividing responsibility for legal risks. This help guide provides clarification on some of the key aspects of your document.

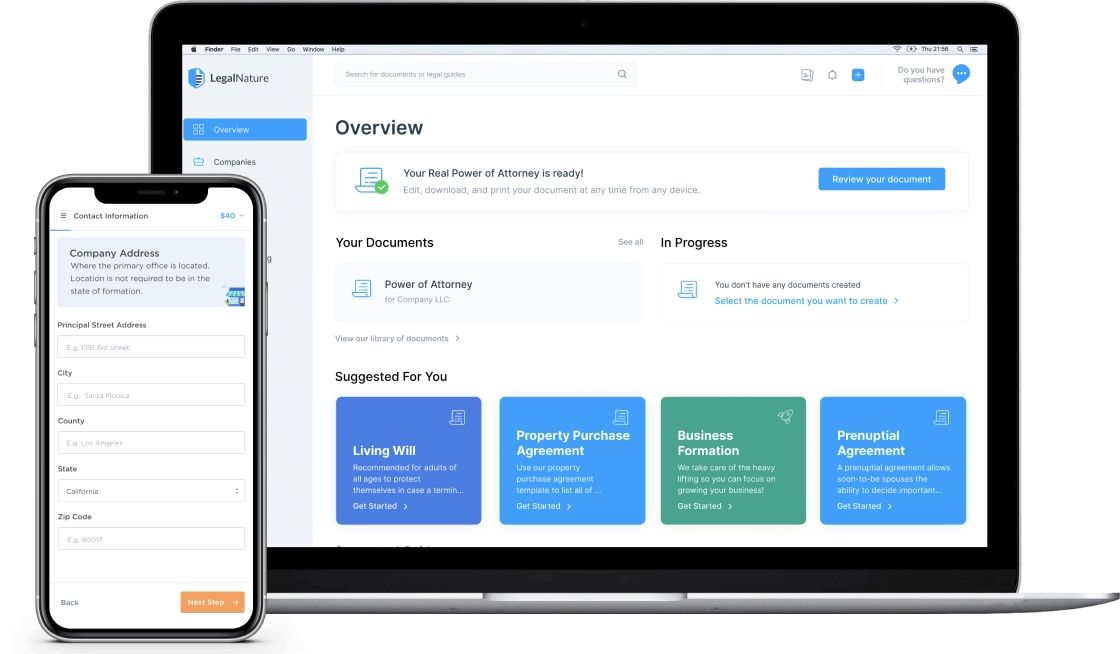

Everything you need for your legal matters, one click away

You'll get a secure personalized dashboard that stores all of your legal forms. Edit, download, and print your documents at any time from any device.

Fast & Easy

Quickly create new documents or business services.

Safe & Secure

Your documents and information are always kept private.

Reliable & Trustworthy

Over 4,000 five star reviews from our customers.

Access Anytime

Everything you need, directly from your dashboard.