When to use a revocable living trust

You would like your estate to pay less probate fees

To transfer assets without going through probate court

One or more properties need to be transferred upon death

Simplify your estate planning

Streamline the process of transferring your most valuable property with a revocable living trust.

Close Transaction

Pay Less in Probate Fees

Save up to 15-20% of the value of the trust in probate fees while ensuring that your assets will be distributed to the beneficiaries.

Present Case

Avoid Probate Court

One huge advantage of this document is that the assets in the trust will avoid probate court upon the death of its creator.

What our customers are saying

How to create a revocable living trust in 3 steps

Complete Obligations

Gather Information

Begin by adding the relevant information for each Grantor, such as name and address. Grantors are the people creating, funding, and signing the revocable living trust's documentation.

Living Trust

Describe the Assets

Enter the name, description, and value of each asset that will be added to the trust. It is very important to provide a description that specifically identifies the asset in order to avoid unwanted confusion

Distribute and Store Questions

Review

After completing your revocable living trust, be sure to review it thoroughly to ensure that it meets your needs. You may make textual edits if you wish. If no changes are needed, you can sign the document and have it notarized.

Help Guide

This guide contains a description of the main sections of our revocable living trust. Note that some of the sections are optional depending on how you answer our questionnaire.

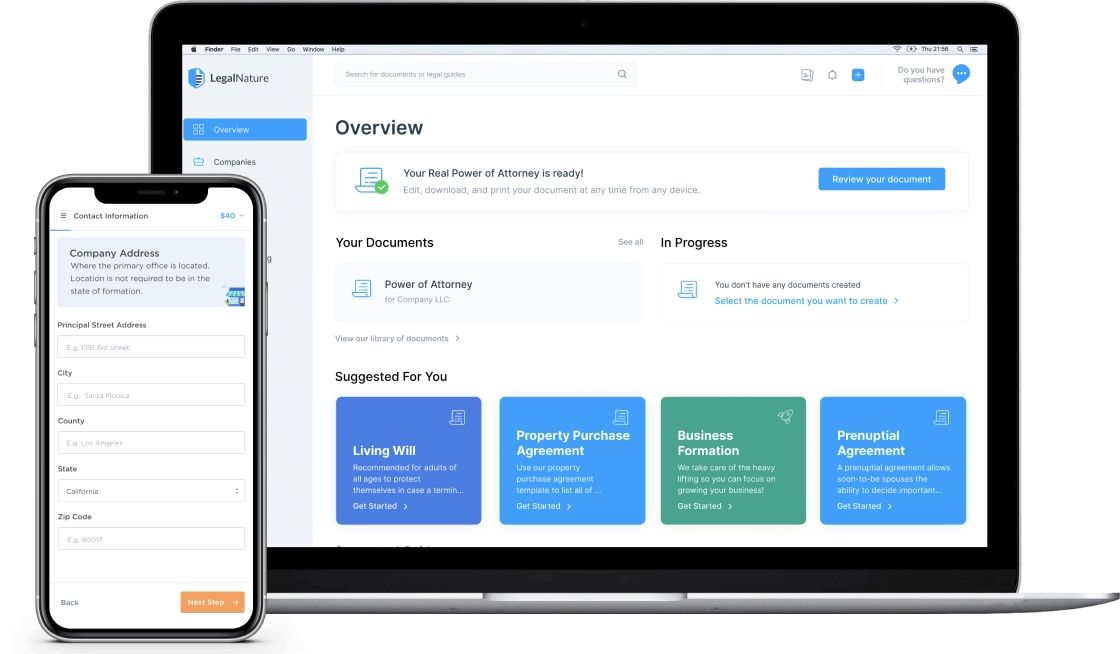

Everything you need for your legal matters, one click away

You'll get a secure personalized dashboard that stores all of your legal forms. Edit, download, and print your documents at any time from any device.

Fast & Easy

Quickly create new documents or business services.

Safe & Secure

Your documents and information are always kept private.

Reliable & Trustworthy

Over 4,000 five star reviews from our customers.

Access Anytime

Everything you need, directly from your dashboard.