When to use a corporate resolution

Authorization to open and operate a company bank account

To record and take action on matters voted on by the board of directors

Buying or selling shares, leasing and managing assets

Borrowing capital or to authorize borrowing on a credit line

To hire and approve actions of members, managers, or employees

Complete Your Corporate Resolution in 3 Steps

Complete Obligations

Gather Information

As you complete your corporate resolution, you will need to provide relevant information about the subject and the maker of the resolution.

Man Laptop Questions

Complete Our Short Questionnaire

Use the information you collected to complete the corporate resolution. We make this easy by guiding you each step of the way and helping you to customize your document to match your specific needs.

Review and Sign

Review and Adopt

It is important to read your resolution thoroughly to ensure it is free of errors and omissions. After completing your Bylaws, they need to be formally adopted by passing a vote at a board meeting, and signing the Certificate of Corporate Resolution page.

Start a new business

LegalNature can help you form a new company quickly and easily. You can choose between four types of companies: LLC, S Corp, C Corp, or a Nonprofit.

Help Guide

Use a corporate resolution (called a "company resolution" for an LLC) to formally record the important binding decisions of a corporation's directors, officers, managers, or owners. A good corporate resolution is customizable to anticipate any resolutions the business's decision-makers may pass. The following guide provides helpful explanations of the more common resolutions your business may encounter in its lifespan.

What our customers are saying

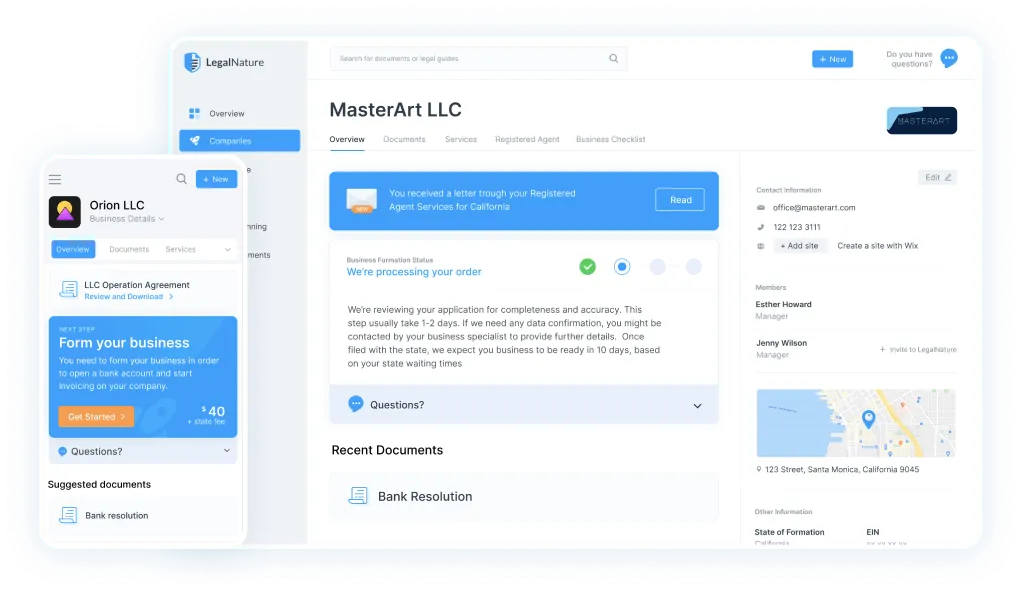

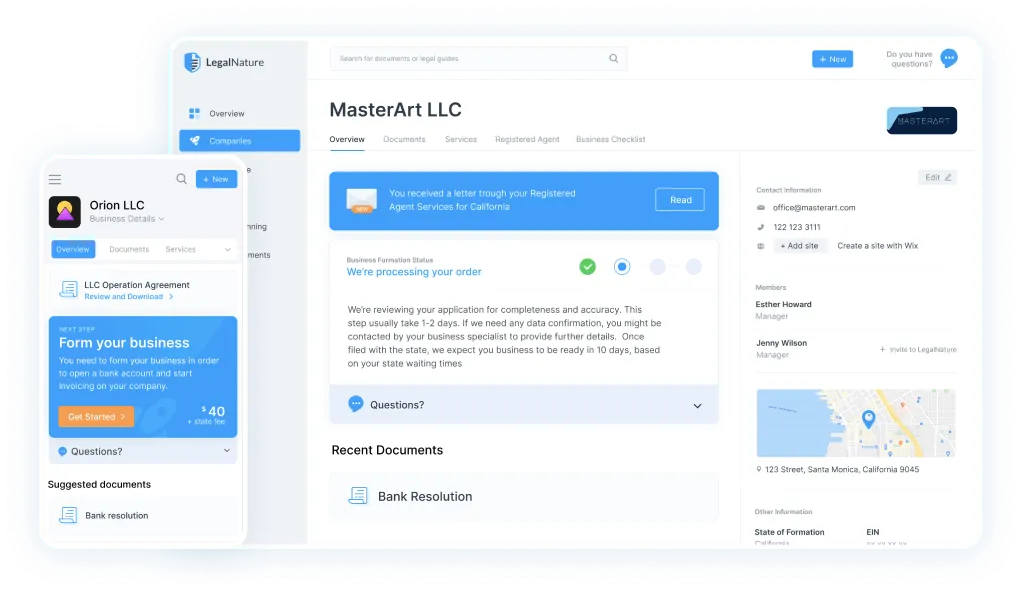

Introducing your business command center

You'll get a secure personalized dashboard that stores all of your legal forms. Edit, download, and print your documents at any time from any device.

Fast & Easy

Quickly create new documents or business services.

Safe & Secure

Your documents and information are always kept private.

Reliable & Trustworthy

Over 4,000 five star reviews from our customers.

Access Anytime

Everything you need, directly from your dashboard.