When to use a lease option agreement

To preserve the tenant's right to purchase the rental property

To indicate any rules that will apply throughout the lease

To provide specific disclosures as required by law or regulation

To have a written agreement defining the lease's most important terms

Draft your lease option agreement the right way

Easily create a clear agreement with our intuitive step-by-step guidance.

People Talking

Avoid misunderstandings

By having a written agreement, all parties will have clear and reasonable expectations.

Close Transaction

Attract quality tenants

Define precise parameters and requirements that must be met by all potential tenants.

What our customers are saying

How to create a lease option agreement in 3 steps

Business Specialist

Gather Information

Start with gathering basic information about the lease, including party information, when the agreement will begin and end, and rent and security deposit amounts. Also, now is a good time to address any special maintenance or repairs that will be needed for the unit. Consider using a rental application to collect this information from your potential tenant or subtenant.

Man Laptop Questions

Answer Key Questions

Use the information you collected to complete your lease option agreement. We make this easy by guiding you each step of the way and helping you to customize your document to match your specific needs. As you answer certain questions, the document will adjust to accommodate your needs.

Distribute and Store Questions

Review and Sign

Always read your document thoroughly to ensure it contains everything you need and is free of errors. In any case, once you finish creating your document, you will be able to alter it as much as you like in Microsoft Word. However, if you do not need to make any changes, you can simply download the PDF version and have the parties sign the agreement.

Help Guide

A good lease agreement should provide the parties with clarity, predictability, and solid legal protection for each part of the rental process. Review this guide for an overview of the main terms and options of a lease with option to purchase.

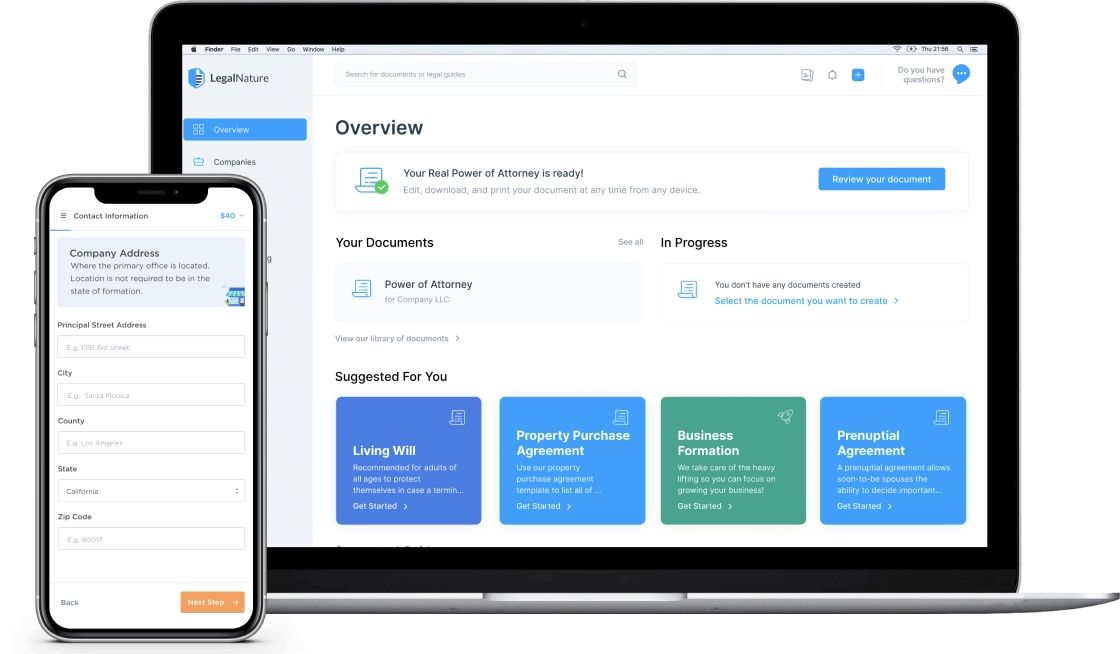

Everything you need for your legal matters, one click away

You'll get a secure personalized dashboard that stores all of your legal forms. Edit, download, and print your documents at any time from any device.

Fast & Easy

Quickly create new documents or business services.

Safe & Secure

Your documents and information are always kept private.

Reliable & Trustworthy

Over 4,000 five star reviews from our customers.

Access Anytime

Everything you need, directly from your dashboard.