Create your S Corp in minutes!

Form an S Corp to take advantages of a corporate structure, while having the benefits of pass-through taxation. You'll get a dedicated expert to take care of forming your S Corp so you can focus on growing your business.

Starting at $49 + state fee

Over 4,000 5 star reviews

Start strong with expert support

Rush and Expedited Filing

Most state processing times vary for filing your formation documents. You have the option to expedite your filing to meet your business needs.

How does it work?

In under 5 minutes you can make sure your S Corp is formed correctly, state compliant, and has the right tools to grow.

Provide your S Corp's information

We file the paperwork with the Secretary of State (SOS).

We obtain your EIN once your business is filed with the SOS.

We provide the documents and suggest next steps for your business, including a business bank account, company website, free tax consultation, and more!

The benefits of forming a corporation

Corporations have many advantages that help their owners stay protected, competitive, and profitable.

Liability Protection

Owners and employees are shielded from becoming personally responsible for the corporation's debts and other obligations.

Raising Capital

Banks and investors consider corporations to be ideal for quickly raising large amounts of capital.

Tax Savings

S corporations receive many tax benefits, including pass-through taxation and numerous tax deductions.

Thousands of people – from business owners to attorneys – use LegalNature every day to manage their business and personal affairs.

Essential guide to

starting a business

Starting a business takes work. There’s no way around it. However, knowing what’s needed and being prepared can help you avoid a lot of the stress and hurdles that slow you down.

Meet your dedicated formation specialist

When you form your corporation with LegalNature, you'll have a dedicated business specialist who will be available for support at every step of the way and communicate with the state on your behalf.

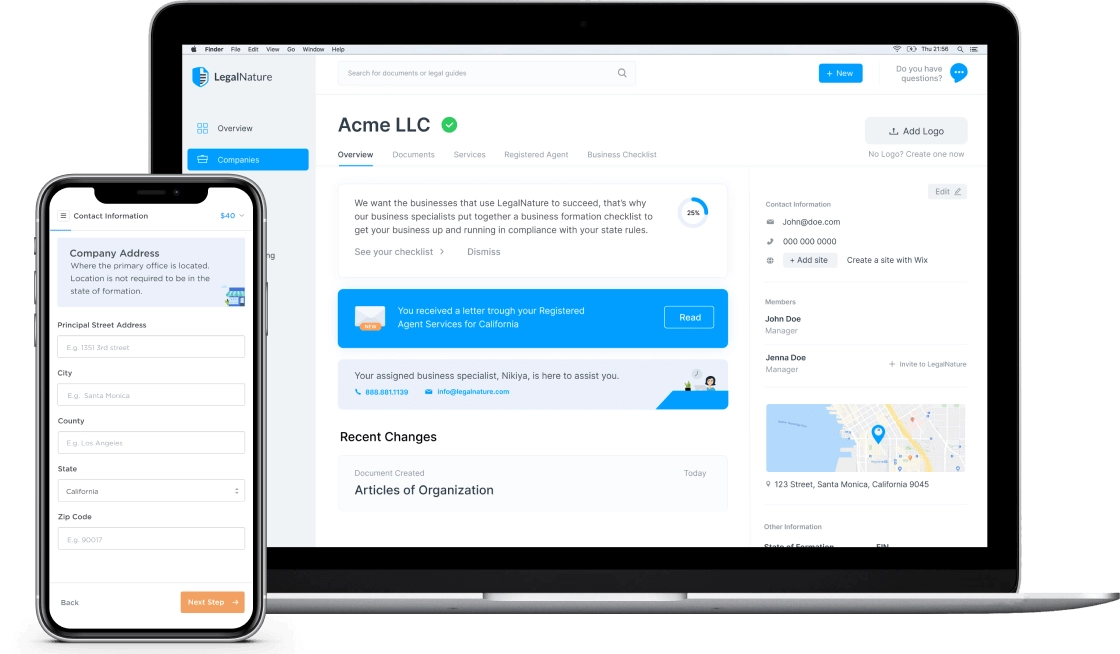

Introducing your business command center

You'll get a secure personalized dashboard that stores all of your legal forms. Edit, download, and print your documents at any time from any device.

Fast & Easy

Quickly create new documents or business services.

Safe & Secure

Your documents and information are always kept private.

Reliable & Trustworthy

Over 4,000 five star reviews from our customers.

Access Anytime

Everything you need, directly from your dashboard.